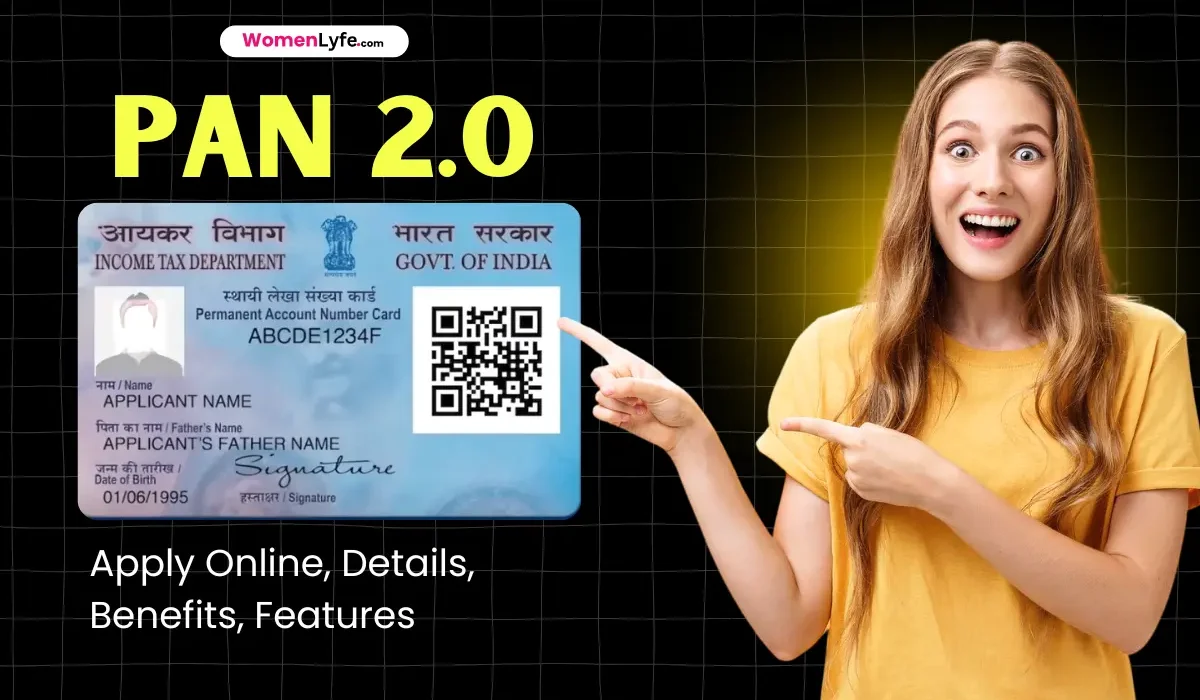

The Income Tax Department has introduced PAN 2.0, a transformative upgrade to the traditional Permanent Account Number (PAN) system. This innovative initiative is designed to enhance convenience, security, and efficiency for taxpayers across India. The standout feature of PAN 2.0 is the provision of e-PAN cards with a QR code, delivered instantly to applicants’ registered email IDs at no cost. While physical PAN cards are available for a nominal fee, it’s worth noting that existing PAN cards remain valid even without the QR code.

Let’s explore the key aspects, benefits, and application process of PAN 2.0, ensuring you make the most of this modernized system.

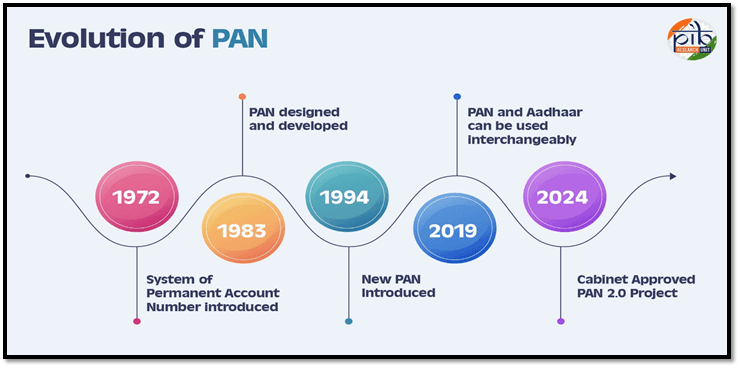

What Is PAN 2.0?

PAN 2.0 is an e-Governance initiative by the Income Tax Department (ITD) aimed at re-engineering taxpayer registration services. By leveraging the latest technology, this project centralizes processes like PAN allotment, updates, corrections, and TAN-related services. PAN 2.0 ensures seamless service delivery to individuals, businesses, and government agencies by consolidating operations under one unified portal.

Key Objectives of PAN 2.0

- Enhanced Convenience: Digitization of services for faster and hassle-free application.

- Improved Security: Incorporation of a QR code to prevent fraud and ensure reliable identity verification.

- Centralized System: Integration of all PAN/TAN-related services on a single platform.

- Accurate Data: Establishing PAN as the primary source of validated taxpayer information.

Top Features of PAN 2.0

1. Pan 2.0 QR Code Integration

The introduction of a QR code on PAN cards is a game-changer. It simplifies identity verification for individuals and businesses by allowing quick access to encrypted data.

2. Online PAN Validation

Government and private agencies, including financial institutions and banks, can now validate PAN details online, reducing delays in processing applications and transactions.

3. Seamless Updates and Corrections

Users can update details like email, mobile number, and address online, free of charge, using Aadhaar-based services. Corrections for name, date of birth, or other details can be processed through existing methods.

Comparison: Old PAN vs. PAN 2.0

| Feature | Old PAN System | PAN 2.0 |

|---|---|---|

| QR Code | Not available | Integrated for security |

| Application Time | 5-7 days | e-PAN in 30 minutes |

| Portal | Decentralized | Unified platform |

How to Apply for PAN 2.0 Online

Applying for a PAN 2.0 e-PAN is a straightforward process. Here’s a step-by-step guide:

- Determine PAN Issuing Authority

- Check the back of your PAN card to identify whether it was issued by NSDL or UTIITSL.

- Visit the Relevant Portal

- For NSDL: Click here.

- Provide Required Details

- Enter your PAN, Aadhaar card number (for individuals), and date of birth.

- Verify Your Information

- Choose a method to receive the One-Time Password (OTP) for authentication.

- Download e-PAN

- Upon successful verification, your e-PAN will be sent to your registered email ID within 30 minutes.

Note: This service is free for up to three requests within 30 days of PAN issuance. Subsequent requests incur a nominal fee of ₹8.26, inclusive of GST.

Updating or Correcting PAN Details

Existing PAN holders can update or correct their details at no cost for the following fields:

- Mobile Number

- Address

For online updates, use these portals:

For other corrections, visit a physical PAN center or apply online through the designated channels.

Documents Required for PAN 2.0

Ensure you have the following documents ready:

- Proof of Identity: Aadhaar, Passport, Driver’s License, or Voter ID.

- Proof of Address: Bank statement, rental agreement, or utility bill.

- Proof of Date of Birth: Birth certificate, school leaving certificate, or Passport.

Benefits of PAN 2.0 for Taxpayers

- Improved Security

- The QR code significantly reduces the chances of duplication or tampering. Encrypted data can only be accessed by authorized software, ensuring secure transactions.

- Faster Transactions

- Instant online verification expedites financial processes, including loan approvals, investments, and account openings.

- Accurate Data Management

- PAN 2.0 ensures taxpayer details are up-to-date and compliant with government regulations.

Spotlight: Why PAN 2.0 Matters

The launch of PAN 2.0 reflects India’s commitment to digital transformation in governance. It aligns with broader initiatives like Digital India, ensuring that essential services are accessible to all citizens. By integrating modern technology, the Income Tax Department is creating a secure, efficient, and user-friendly system that benefits taxpayers and organizations alike.

For further assistance with PAN 2.0, contact:

- Email: tininfo@proteantech.in

- Helpline Numbers: 020 27218080 or 020 27218081

PAN 2.0 is a pivotal step in simplifying taxpayer services while ensuring robust security and efficiency. Embrace this upgrade and enjoy the convenience of digital governance at its best.

Frequently Asked Questions

1. Is the e-PAN valid like a physical PAN?

Yes, it is legally equivalent.

2. Can I update my PAN details online?

Yes, via NSDL or UTIITSL portals.

3. Is PAN 2.0 mandatory?

No, existing PANs remain valid.

4. No, existing PANs remain valid.

It uses encrypted data accessible only by authorized systems

5. What if I lose my e-PAN email?

Request a resend from the NSDL portal.

6. Are there any charges for corrections?

Updates like email and address are free; others may incur fees.

Also read

- Capital Gains Tax in India: 2 Types, Tax Rates You Should Know

- Cost Inflation Index: How Does It Work? Explore Now

- How to Invest in Stocks: 8 Best Essential Steps for Investing